Trading books found on Patrick Walker’s shelf

William O’Neil

How to Make Money in Stocks

A foundational guide to investing in the stock market, this book introduces O’Neil’s CAN SLIM strategy, combining fundamental and technical analysis to identify high-growth stocks.

“What seems too high and risky to the majority generally goes higher, and what seems low and cheap generally goes lower.”

Other amazing books by William O’Neil:

The Successful Investor

24 Essential Lessons for Investment Success

How to Make Money Selling Stocks Short

Mark Minervini

Trade Like a Stock Market Wizard

Learn the strategies behind one of the most successful traders of our time. Minervini shares his SEPA (Specific Entry Point Analysis) methodology, focusing on finding early-stage growth stocks.

“The stock market is a game of probabilities, not certainties. Your goal is not to be right all the time, but to make more when you’re right than you lose when you’re wrong.”

Other must-read books by Mark Minervini

Think and Trade Like a Champion

Mindset Secrets for Winning

Jack Schwager

Market Wizards

A compilation of interviews with legendary traders, this book offers timeless insights into their strategies, philosophies, and personal journeys. Readers are especially encouraged to explore the final chapter, where Schwager interviews Dr. Van K. Tharp, focusing on the critical role of trading psychology. Tharp provides valuable insights into the mindset, emotional discipline, and self-awareness essential for long-term market success.

Other great books by Jack Schwager

The New Market Wizards

Stock Market Wizards

Hedge Fund Market Wizards

Unknown Market Wizards

William L. Jiler

How Charts Can Help You in the Stock Market

This classic provides an introduction to technical charting, explaining how to interpret price and volume trends to make informed trading decisions.

“Successful chart reading is not a science; it is an art.”

Jiler touches on the psychological aspect of trading and how crowd behavior influences chart patterns. This is a precursor to what modern traders now call behavioral finance.

Successful chart reading requires practice, patience, and the discipline to follow what the charts indicate, even when it contradicts personal biases.

Martin Zweig

Winning on Wall Street

A highly regarded guide that emphasizes the importance of understanding market trends and using technical indicators for timing investment decisions.

“The idea is to buy when the probability is greatest that the market is going to advance.”

Zweig was a big proponent of using sentiment indicators to gauge the mood of the market. He believed that extreme optimism often signals market tops, while extreme pessimism can indicate market bottoms.

Zweig encouraged investors to focus on companies with strong earnings growth.

Edwin Lefevre

Reminiscences of a Stock Operator

A semi-autobiographical account of the life of famed trader Jesse Livermore, this book explores the psychology of trading and timeless lessons about market behavior.

“A stock chart is the map of the market. Just as a traveler relies on a road map to navigate unfamiliar terrain, the investor should rely on charts to navigate the market.”

LeFèvre discusses the concept of support (price levels where demand is strong enough to halt a decline) and resistance (price levels where selling pressure prevents an advance). Recognizing these levels is critical for timing entry and exit points.

The strength of this book lies in its simplicity and clarity, making it an excellent guide for those new to technical analysis while still offering timeless insights for seasoned investors.

Nicolas Darvas

How I Made $2,000,000 in the Stock Market

Darvas shares his famous “Box Theory” for identifying and riding stock trends, written in an accessible and engaging style.

“I became convinced that to be successful in the stock market, it was necessary for me to study and follow a stock’s price action rather than its fundamentals.”

Darvas developed the “Darvas Box” method, a technical trading strategy that focuses on identifying stocks in a strong upward trend and trading them within a specific price range or “box.”

One of the best takeaways is how Darvas relied on his own research and analysis rather than market chatter or so-called “expert” advice. His independent mindset is both inspiring and empowering.

Michael W. Covel

Trend Following

An in-depth exploration of the trend-following approach to trading, emphasizing patience, discipline, and the importance of cutting losses.

“The trend is your friend until the end when it bends.”

Covel emphasizes the importance of maintaining emotional discipline. Trend following requires traders to stick to their systems, even during extended periods of drawdowns or volatility.

One of the strongest sections of the book focuses on risk management. Covel stresses the importance of cutting losses quickly, letting profits run, and sizing positions appropriately. This disciplined approach to managing risk is critical to long-term success.

John Boik

Lessons from the Greatest Stock Traders of All Time

Boik examines the lives and techniques of historical trading legends, offering practical lessons for modern traders.

“History doesn’t repeat itself exactly, but it does rhyme. Study the past so you can capitalize on the future.”

Another important takeaway is that even the greatest traders had their setbacks. Boik shows how many of these individuals turned losses into valuable learning experiences, and this resilience was often key to their long-term success.

Stan Weinstein

Secrets for Profiting in Bull and Bear Markets

Weinstein introduces his Stage Analysis, a four-phase price cycle that emphasizes identifying optimal entry points based on price structure and momentum. His focus on Stage 2 breakouts, where price emerges from a consolidation with rising volume, aligns closely with Pat Walker’s approach at Mission Winners. Pat emphasizes clean, simple breakouts from flat bases with volume confirmation, mirroring Weinstein’s principles while keeping the process easy to identify and act on for traders.

“It is not the strongest of the species that survive, nor the most intelligent, but the one most responsive to change.”

A key takeaway is the mental discipline required to trade effectively. Weinstein emphasizes that one of the biggest challenges traders face is controlling emotions, especially during volatile market phases.

Robert Koppel and Howard Abell

The Inner Game of Trading

A psychological guide for traders, focusing on understanding and overcoming emotional

challenges to improve performance.

“The greatest barrier to success in trading is not the lack of a good system, but the inability to handle yourself.”

One of the central themes of the book is self-awareness. Koppel and Abell emphasize that understanding your own thoughts, emotions, and behaviors is crucial for becoming a successful trader. They argue that most traders struggle not because they lack technical skills, but because they are unable to manage their internal state during times of stress, fear, or greed.

Dave Landry

Dave Landry on Swing Trading

In this comprehensive guide, Dave Landry shares his complete swing trading methodology, offering more than a dozen momentum-based strategies that capitalize on market movements. The book covers trend qualifiers, stock selection, swing trading strategies, market timing, money management, and trader psychology, providing both beginners and intermediate traders with the tools needed to trade successfully.

“The trend is your friend, but the risk is your responsibility.”

Landry also provides strategies for adapting to different market conditions. Whether the market is trending or choppy, he offers actionable advice on how to adjust your approach to ensure profitability.

Inspirational books from Pat’s collection

Atlas Shrugged by Ayn Rand

Anthem by Ayn Rand

The Killer Angels by Michael Shaara

Blue Highways by William Least Heat-Moon

The Winds of War by Herman Wouk

War and Remembrance by Herman Wouk

A Walk in the Woods by Bill Bryson

The Fountainhead by Ayn Rand

The Amazing Results of Positive Thinking by Norman Vincent Peale

Chicken Soup for the Soul by Jack Canfield and Mark Victor Hansen

We the Living by Ayn Rand

The Endurance: Shackleton’s Legendary Antarctic Expedition by Caroline Alexander

Shiloh by Shelby Foote

The 5000 Year Leap by W. Cleon Skousen

The Prophet by Kahlil Gibran

American Icon: Alan Mulally and the Fight to Save Ford Motor Company by Bryce G.

Hoffman

Just Like Jesus by Max Lucado

In the Grip of Grace by Max Lucado

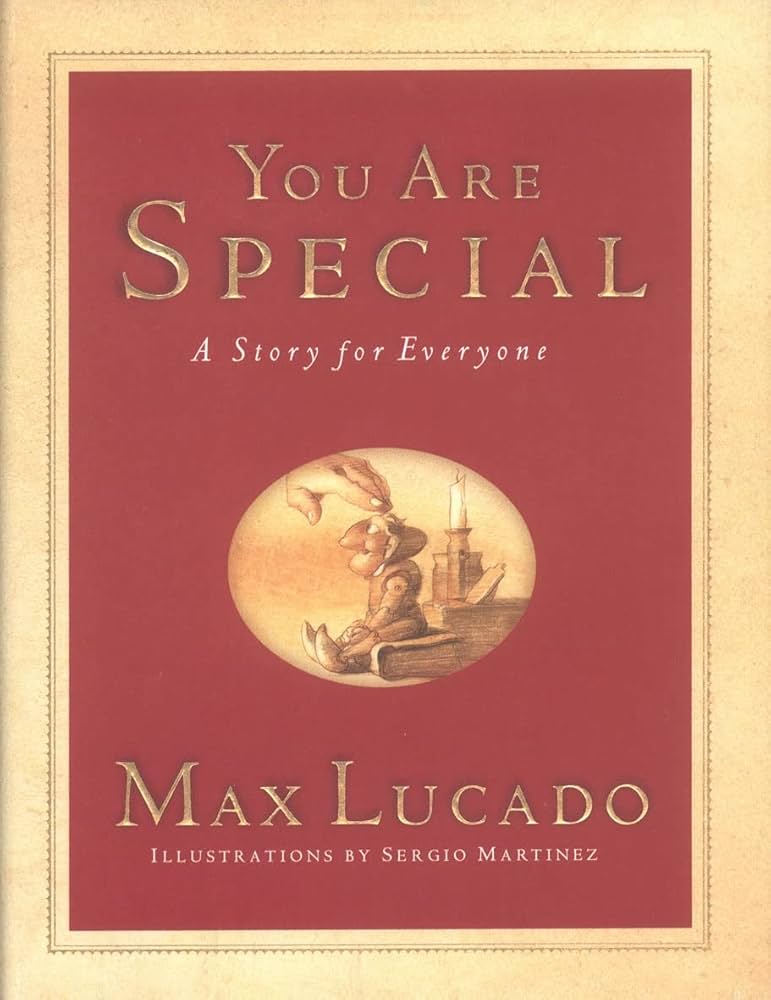

You Are Special by Max Lucado

The Bible: A Cornerstone in Patrick Walker’s Personal Library

Among the diverse array of books in Patrick Walker’s personal collection, the Bible holds a special place as a fundamental source of wisdom and guidance. Pat’s life demonstrates a commitment to integrating his faith with every aspect of his personal and professional endeavors.

The teachings of the Bible resonate deeply with Pat, shaping his approach to education, community service, and family life. His involvement as a youth group leader, alongside his decision to send his children to private Christian institutions and his role in teaching Sunday school, reflect his dedication to the principles he values. These commitments are grounded in the moral and ethical teachings that the Bible espouses.

Moreover, Pat’s roles as a professor, mentor, and Scout leader are influenced by the values of leadership, integrity, and service that he draws from his faith. His selection of the Bible as a personal favorite underscores its role in providing spiritual and moral guidance, which he seeks to share through his extensive community and educational work.

This book is not just a religious artifact for Pat but a living document that informs his daily decisions and interactions. It represents a cornerstone of his philosophy and practice, making it a crucial part of his personal book list.